About Hamilton Insurance & Financial Management

“It’s all about knowledge – so when you have little time to spare, how do you know what opportunities are being missed?”

Rod Hamilton, CFP®

Financial Planner

The stress is in the uncertainty – get clear, solid advice for your financial health.

Wealth management and taxation are all about knowledge. Things change constantly in the markets and in your own life, so which strategy you choose can be just as important as when you choose it.

As a busy professional, you’re always wondering what opportunities you could be missing, what new challenges need to be resolved, what life changes need to be addressed – and these unknowns become a constant source of stress. But when all these unknowns become clear facts, your wealth can actually be aligned with the objectives and opportunities in your life.

After four generations helping professionals and business owners across Ontario and Québec, we’ve built into our practice the capabilities to implement the right strategies at the right time in your life, from building up your wealth to saving tax, improving your financial health and preserving income in retirement – which might be more achievable than you think.

“Rod, there were a number of challenges in my life this year with the biggest being able to finally settle my personal situation. It feels great and I wanted to once again extend my appreciation to you for all your help. You are special people and I couldn’t have done it without you. During stressful times, it was great to know I could count on you, not only for your business acumen but also your support with a caring and non-judgemental attitude, whether a quick response, advice, sober feedback or personal opinions, you were always there and then, just getting it done.”

Frank

As you go through life, your needs change.

And depending on which stage of life you’re in your financial opportunities – and your options to take advantage of them – will often change as well.

With a unique mix of in-house experts, a network of external specialists and a foundational background in tax strategy, our practice is structured to serve these evolving needs over the course of your professional career, and through your retirement.

Our services include: Financial planning, tax-management strategies for pre- and post-retirement Projecting and managing cash flow Retirement income planning and supporting your retirement lifestyle Planning for retirement and strategies to retire early Investing tax-efficiently with Tax-Free Savings Accounts and other unique strategies Life insurance and other strategies to protect your wealth Estate planning, building a legacy and transferring family wealth tax-efficiently. Custom portfolio design with market analysis and goal-oriented planning Ongoing client education, reporting and personal communication Wealth planning for business owners and incorporated professionals, including doctors and dentists. This often includes selling a practice or business, or, sometimes, buying one.

“Flexibility is central to our relationships with our clients. Every situation has its own challenges, many of which can be time-sensitive, so it’s important to adapt to the needs of the individual, even if it’s as simple as driving out to your place of business to save you the trip. We truly are focused on you.”

Hamilton Insurance and Financial Management

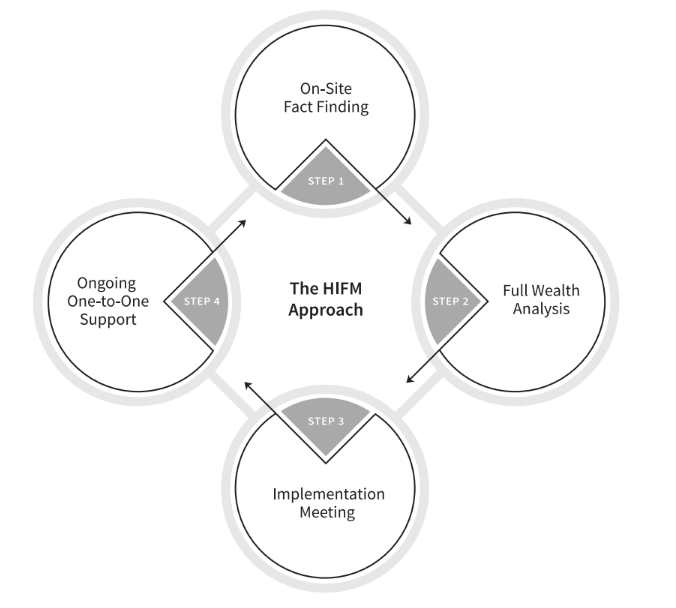

The HIFM Approach

Our business is multigenerational and many of our clients have similar goals for their family wealth. This common ground helps us to establish the strong communication necessary to keep up with the changing needs of your life and personal wealth, and to transition wealth to the next generation.

STEP 1 On-Site Fact-Finding

Our first meeting, if possible, takes place at your home or place of business. We sit down to discuss your objectives and past experiences, and to gather essential data.

STEP 2 Full Wealth Analysis

We examine your existing holdings, investments and strategies. We identify ways to restructure your wealth for greater tax-efficiency, growth and retirement preparation, depending on your current needs.

STEP 3 Implementation Meeting

We present our recommendations in three main categories: investing, tax and estate, and insurance. We discuss and clarify before beginning implementation because we truly care. This is all about you.

STEP 4 Ongoing One-to-One Support

With a focus on client education, we monitor results and provide ongoing support to ensure our strategies adapt to your changing needs.

.jpg) |

|

Testimonials

“Rod,

There were a number of challenges in my life this year with the biggest being able to finally settle my personal situation. It feels great and I wanted to once again extend my appreciation to you for all your help. You are special people and I couldn't have done it without you. During stressful times, it was great to know I could count on you, not only for your business accumen but also your support with a caring and non-judgemental attitude, whether a quick response, advice, sober feedback or personal opinions, you were always there and then, just getting it done.”

– Frank

“Rod,

On behalf of Alie and myself, a special thanks for all the work/advice you have given us over the years to change our financial position. As you well know, a number of years ago, we had invested a lot of money. We were assured (almost guaranteed) that these were very sound investments. We trusted this individual who claimed to be our financial adviser. When the smoke had cleared all of the investment money was gone. Alie and I were in shock. Imagine our response when your first letter arrived. We were still spinning and pretty skeptical, so we started out slowly reinvesting and we seemed to be making some headway with our new adviser and on our way with sound judgment at last… Yah.

We have now retired and the decision was to sit down with you (Rod) and develop a plan for retirement. All we can say about this plan is I can sleep at night without any worries of finance. We have retired to a place in Arizona for the winter and live in Ontario for the summer. Our adventures have not stopped there as we have been cruising for the past 6 years and will continue to do.

In a final note I find dealing with you (Rod) a pleasure as the questions I ask, I get a straight answer and our camaraderie is a delight. Alie and I made no mistake when we met you.

Sincerely,”

- Thom & Alie